Automotive Electronics Market set to grow

With vehicles getting smarter, more connected and more autonomous, the automotive electronics market looks set to soar.

Future growth in numbers

Back in March, Precedence Research predicted the automotive electronics market would hit around US$ 640.56 billion by 2030.

Then, in July, Global Market Insights released research predicting the automotive electronics market would hit around US$ 380 billion by 2027.

Interestingly, measured across the same period, both research reports (which are independent) predict a similar growth pattern. Global Market Insights predicts a 6% CAGR, while Precedence Research predicts a CAGR of 7.64% over a 3-year longer period.

With two separate reports indicating significant annual growth. The automotive electronics market looks set to boom. But wait, there’s more.

A 9.3% CAGR is expected in the automotive electronics market by 2030, according to research by P&S Intelligence. They predict slightly less growth than Precedence Research to 2030, at US$ 615.3 billion (versus $640.56 billion).

Growth factors

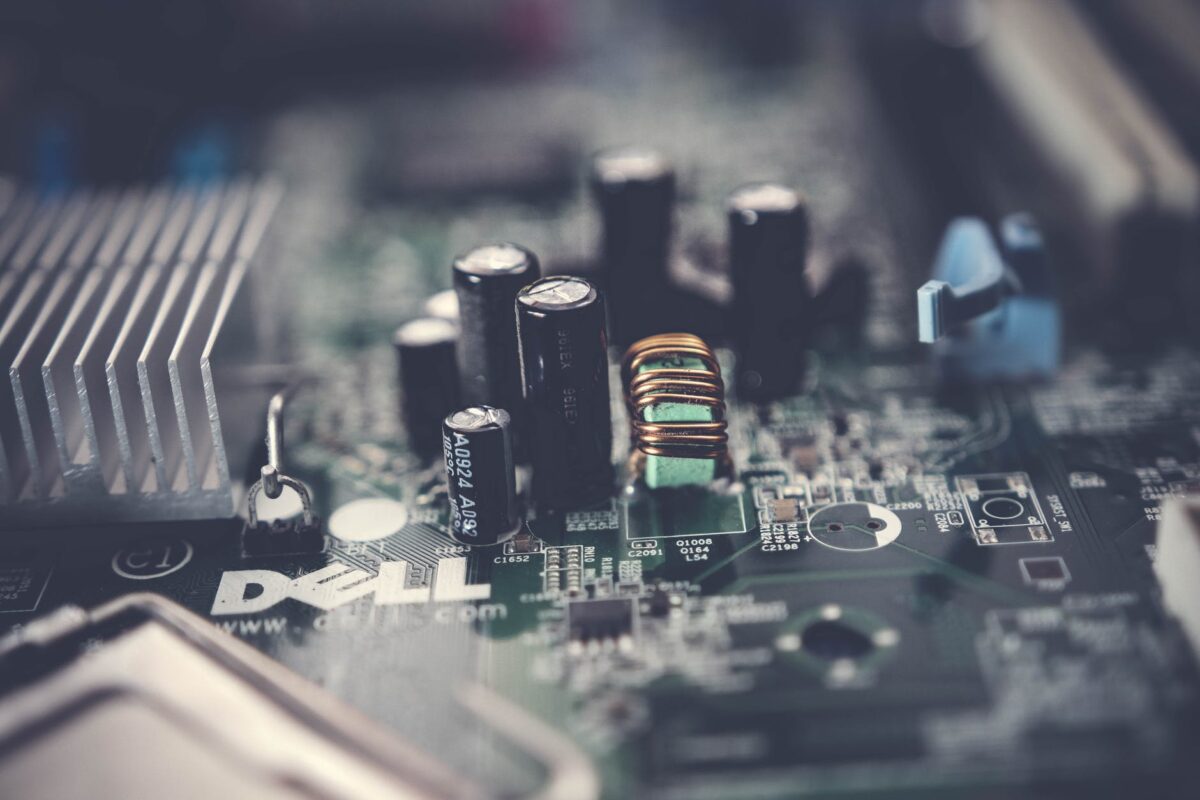

There are approximately 1,400 chips in a typical vehicle today. Which each chip housing thousands of components on a semiconductor wafer, creating integrated circuits that power computing, memory, and a host of other tasks.

Those are just the chips.

Cars have thousands of other electronic components, including passive, active and interconnecting electronic components. From batteries, sensors and motors, to displays and cameras. Oh, and everything is connected.

All told, a typical car today has more than 50,000 electronic components that enable features like in-car Wi-Fi, self-parking technology, adaptive headlights, semi-autonomous driving technology, keyless entry, and powered tailgates.

However, cars are getter smarter and more advanced. Electronic components today make up around a third the cost of a car, which will increase over time as more sophisticated and greater numbers of components are used.

Smarter cars need more components

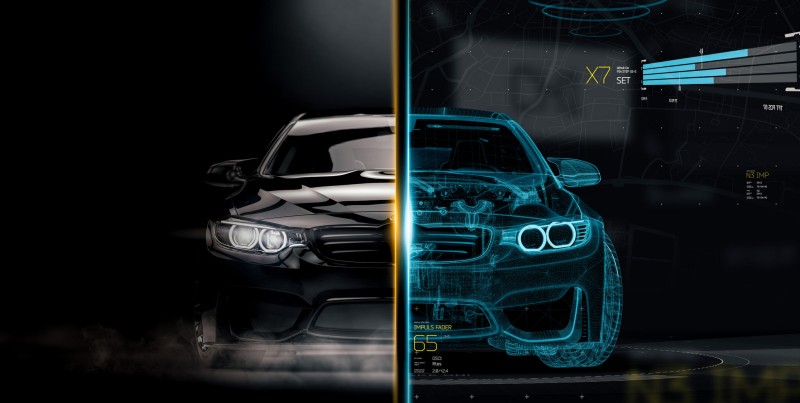

The future of cars involves electrification, autonomous and self-driving technologies, hyperconnectivity, Internet of Things, augmented reality, artificial intelligence, biometrics and a whole host of next-generation technologies.

How will these be enabled? With electronic components.

Let’s take electrification as an example. An electric car handbook will tell you an electric car has a motor, a battery, an on-board charger, and an Electronic Control Unit (ECU) that controls one or more of the electrical systems or subsystems in the vehicle. Together, these let you drive around, charge, and pop to the shops.

In-between these systems, are hundreds of thousands of electronic components that make them work. You see, an Electronic Control Unit is a single component, containing thousands of smaller components, each performing a critical role.

The automotive electronics market is set to soar because cars and other vehicles will need more components with electrification and next-gen technologies. Sometimes, things can be simple to explain, and this is one of those times.

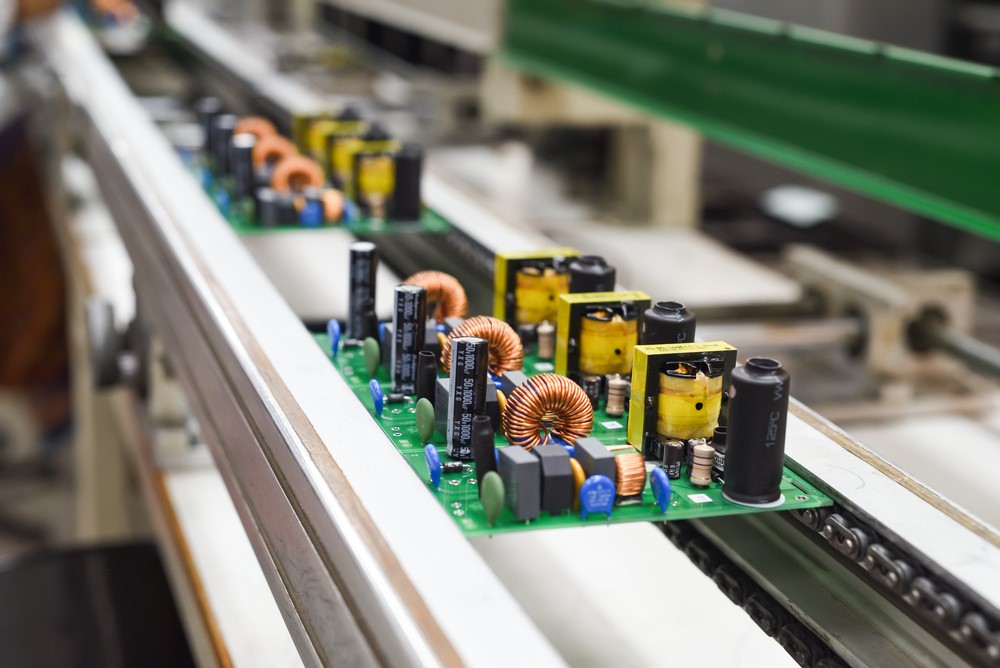

Meeting demand

The electronics industry is facing a global chip and electronic component shortage which is expected to last 2-3 years. As demand for automotive electronics soars, shortages look very likely for certain components like CPUs and memory.

The solution for many companies will be to use an electronics component distributor, to fill gaps in the supply chain and keep things moving.

Electronic component distributors like Lantek can source hard-to-procure components because we have relationships with the best suppliers in the industry. Contact us today with your inquiries at sales@lantekcorp.com or call 1-973-579-8100