Over the next decade, demand for semiconductors is going to go supersonic thanks to secular and cyclical tailwinds.

Semiconductors are the building blocks of the information age; every device that will be ‘connected’ needs a semiconductor. The companies that manufacture semiconductors are the unsung heroes of the future. But who are they?

In this article, we will briefly cover the biggest players in the semiconductor industry.

Foundries

Foundries concentrate on manufacturing and testing physical products for fabless companies. Some companies, like Intel, are both fabless and foundry, meaning they design and make their chips. Foundries often serve as a non-competitive manufacturing partner for fabless companies. The following list contains the biggest foundries:

TSMC

TSMC (Taiwan Semiconductor Manufacturing Company) is the world’s largest semiconductor manufacturer by a significant margin. They are expected to capture 56% of the semiconductor market in 2021 (up from 54% in 2020).

UMC

UMC (United Microelectronics Corporation) is a Taiwanese company. They are the second largest semiconductor foundry in the world behind TSMC. UMC specialise in mature nodes, such as 40nm nodes and other speciality logic.

SMIC

SMIC (Semiconductor Manufacturing International Corporation) is a Chinese company. They are the third largest semiconductor manufacturer in the world. They specialise in process nodes from 0.35 micron to 14 nanometres.

Samsung

Samsung Electronics is a South Korean company. They are the world’s largest manufacturer of DRAM and the world’s fourth largest semiconductor manufacturer. They are expected to occupy 18% of the semiconductor market in 2021.

Micron

Micron is an American company. They are the second largest manufacturer of DRAM (dynamic random-access memory) behind Samsung. DRAM is semiconductor memory used in consumer electronics, computing equipment and IoT devices.

SK Hynix

SK Hynix is a South Korean company. They are the world’s third largest manufacturer of DRAM and a leading manufacturer of NAND flash memory. In 2019, they developed HBM2E, the world’s fastest high bandwidth memory.

NXP Semiconductors

NXP Semiconductors is a Dutch-American company. They manufacture ARM-based processors, microprocessors and logic across 8, 16 and 32-bit platforms. Their products are used in automotive, consumer, and industrial markets.

Powerchip

Powerchip Technology Corporation is a Taiwanese company. They manufacture DRAM and memory chips, semiconductors and integrated circuits. They use a 300mm wafer production technology which can produce advanced and mature chips.

ON Semiconductor

ON Semiconductor is an American company. They design and fabricate chips and microprocessors for automotive, aerospace, industrial, cloud and Internet of Things devices. They have over 45 years’ of experience in the foundry business.

Fabless companies

“Fabless” means outsourced fabrication. Fabless companies concentrate on the research and development of chips and semiconductors. They then outsource the manufacturing of the product to a foundry. This relationship is non-competitive, and the foundry is normally a silent partner. The following list contains the biggest fabless companies:

MediaTek

MediaTek is a Taiwanese company. By market share, they are the world’s leading vendor of smartphone chipsets. They are also a leading vendor of chipsets for other consumer electronics including tablets and connected TVs.

Qualcomm

Qualcomm is an American company. They are the world’s biggest fabless company. Their product catalogue includes processors, modems, RF systems, 5G, 4G and legacy connectivity solutions. They are best-known for Snapdragon Series processors.

Broadcom

Broadcom is an American company. Depending on which figures you read, they are either the first or second largest fabless company in the world. Broadcom’s products serve the data centre, networking, software, broadband, wireless, and storage and industrial markets.

NVIDIA

NVIDIA is an American company. They are the market leader for high-end graphics processing units (GPUs). In 2020, NVIDIA GeForce GPUs accounted for 82% of GPU market share. This is significantly more than AMD Radeon graphics cards, which accounted for 18%.

AMD

AMD is an American company. They design high-performance GPUs and processors for computers, where they command the second biggest market share behind Intel. Their GPUs compete against NVIDIA’s but are not considered as powerful.

Himax

Himax is a Taiwanese company. They are a leading vendor of automotive chips and semiconductors for connected devices. Their semiconductors are used in TVs, monitors, laptops, virtual reality headsets, cameras and much more.

Realtek

Realtek is a Taiwanese company. They are a fabless semiconductor company focused on developing IC products (integrated circuits). They are best-known for SoCs (System-on-Chips) network (Ethernet) and wireless (Wi-Fi) interface controllers.

Integrated device manufacturers

Some companies have foundry and fabless arms. These companies often design and fabricate their own products or design and fabricate chips for others. These integrated device manufacturers (IDMs for short) blur the line between foundry and fabless with an in-house production process that utilises little if any outsourcing. IDMs include:

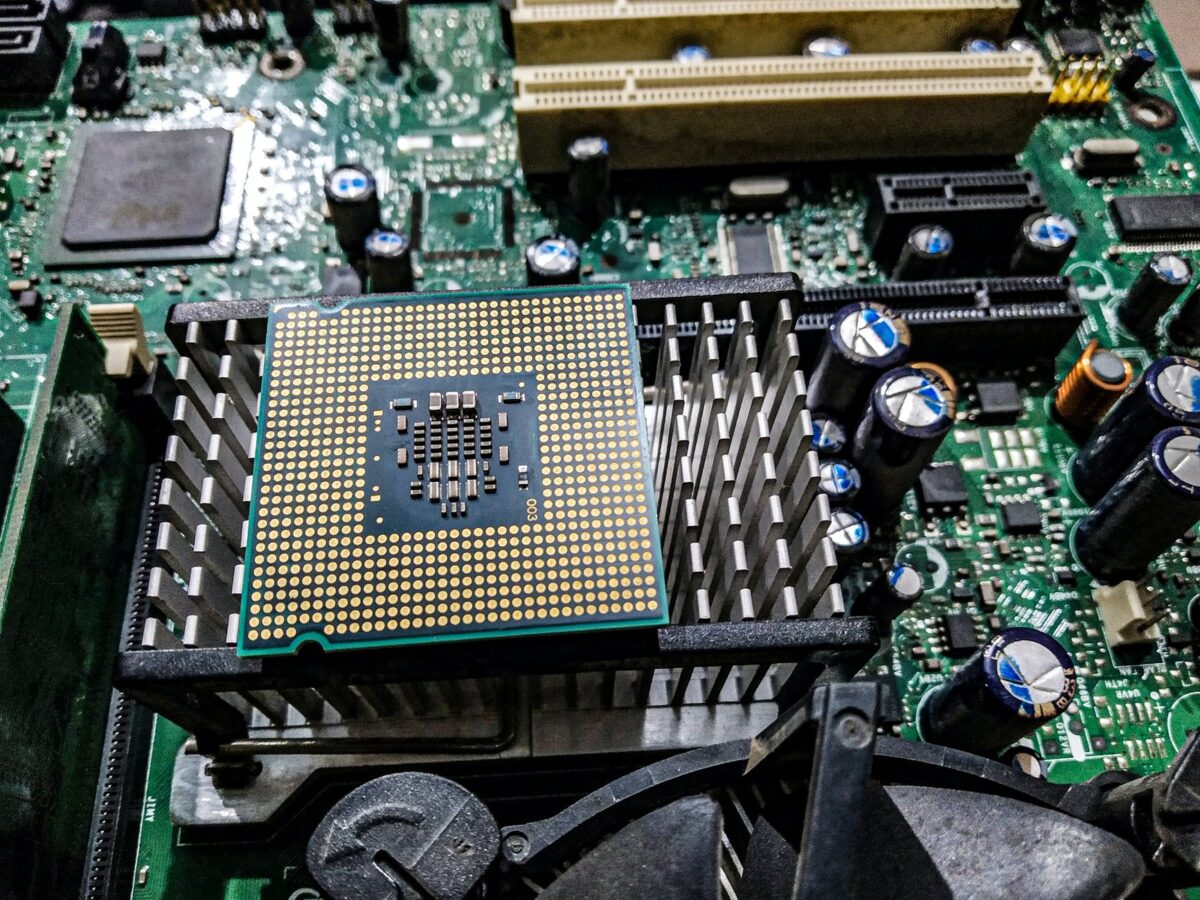

Intel

Intel is an American company. They design and manufacture their own chips which they package into CPUs. Intel’s market share in the CPU market has declined in recent years, but they remain one of the top semiconductor manufacturers.

Analog Devices

Analog Devices is an American company. They have a 150mm wafer fab and a 200mm wafer fab. They have fabless production facilities and have made numerous fabless acquisitions over the years, such as OneTree Microdevices in 2017.

Texas Instruments

Texas Instruments is an American company. They have 14 manufacturing sites including silicon foundries. They specialise in the production and manufacture of wafers, digital signal processors, integrated circuits and embedded processors.

Overall

You may have noticed that the US and Taiwan dominate the semiconductor industry on the foundry and fabless side. Among the biggest semiconductor companies, the largest proportion are based in the United States. However, Taiwan is the foundry king, with the two biggest players based there (TSMC and UMC).

Semiconductors are used in all electronics that require computing power, including smartphones, PCs, and data centres and cars. A surge in demand for chip-based products will fuel the need for more semiconductors in the future. It will be up to the big players on this list to meet that demand and power our future.