Tech industry bracing for a potential shortage of passive electronic components

By now, everyone has heard of the global semiconductor shortage. Still, the tech industry is bracing itself for an altogether larger shortage of passive electronic components that could reduce manufacturing output across multiple categories.

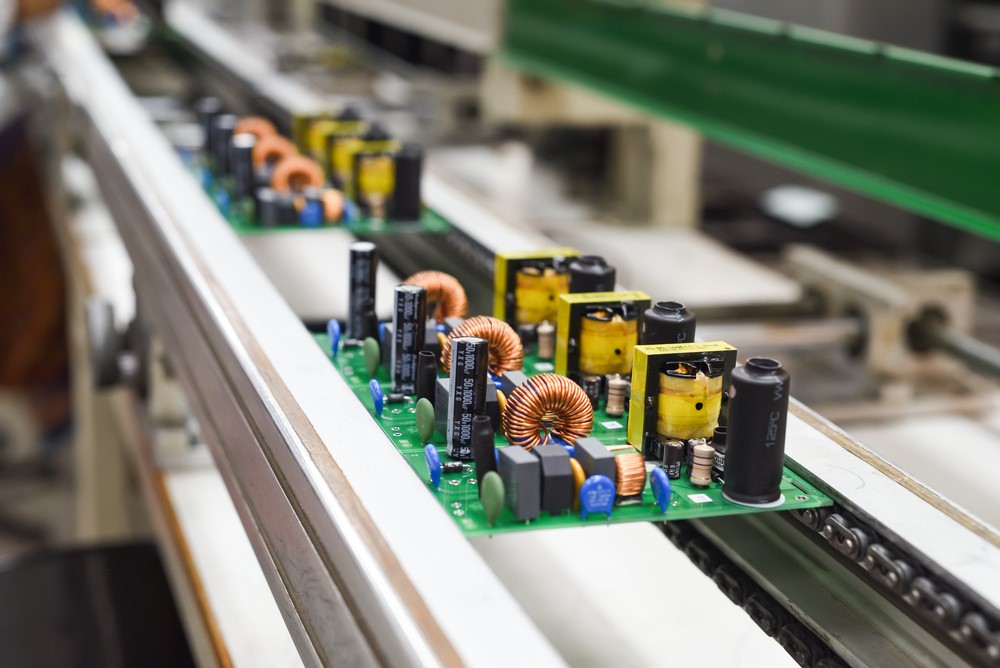

Passive components do not generate energy but can store and dissipate it. They include resistors, inductors (coils), capacitors, transformers, and diodes, connecting to active elements in circuits. Passives are necessary for circuit architecture, so the shortage is bad news for the electronics industry as a whole.

The current state of the passive component shortage

The truth is there has been a shortage of certain passive components since the coronavirus pandemic hit in 2020, particularly with multilayer ceramic capacitors (MLCCs), which can be difficult to get hold of in large quantities.

Certain diodes, transistors and resistors are also in shorter supply than they were in 2019, partly because of the pandemic and a shift in manufacturing investment for active components, which have a higher margin.

You also need to look at consumer trends (what people are buying). Smartphone and smartwatch sales are higher than ever, and smart ‘Internet of Things’ devices are growing in popularity rapidly, not to mention in availability.

These devices require a lot of passive components. For example, a typical smartphone requires over 1,000 capacitors. Cars are also huge consumers of passive components, with an electric car requiring around 22,000 MLCCs alone.

The trend for next-generation technology adoption is up across all categories, be it the Internet of Things, edge computing, semi-autonomous cars and 5G. Passive components are in more demand than ever at a time when supplies are under pressure.

Price rises are now inevitable

The price for most passive components has risen by the largest amount in over a decade in 2021, caused by supply and demand economics and a price explosion for common materials like tin, aluminium and copper, as well as rare earth metals.

While some suppliers can afford to take a hit on profits, for most, raising prices is inevitable to ensure the viability of operations.

With higher component prices and greater shortages, it is more important than ever for companies to bolster their supply chains. Complacency is dangerous in today’s market, and no company is immune to disruption.

How to beat the passive components shortage

The passive components shortage is likely to get worse before it gets better, but there are several ways you can bolster your supply chain:

- Equivalents: Specifying equivalent passive components is a sound way to keep your supply chain moving. When a specific passive component isn’t available, an equivalent may be available that functions in exactly the same way.

- Ditch outdated components: Outdated components have limited or no manufacturing output when discontinued. Upgrading to modern components that are manufactured in larger quantities can help you meet demand.

- Partner with a global distributor: Global components distributors like us source and deliver day-to-day, shortage, hard-to-find, and obsolete electronic components. We can help keep your supply chain moving in uncertain times. Contact us today with your inquiries.