The effect of AI on the electronics supply chain

AI and machine learning technology is improving all the time and, consequently, the electronics industry is taking more notice. Experts predict that the application of AI in the semiconductor industry is likely to accelerate in the coming years.

The industry will not only produce AI chips, but the chips themselves could be harnessed to improve the efficiency of the electronic component supply chain.

What’s included

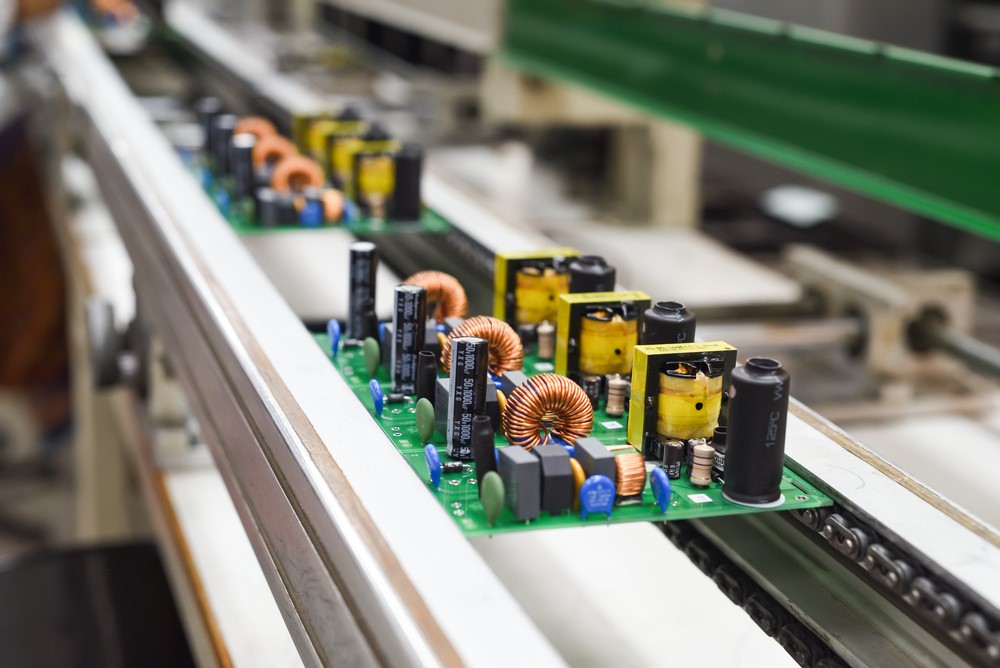

In an AI chip there is a GPU, field-programmable gate arrays (FPGAs), and application-specific integrated circuits (ASICs) specialized for AI.

CPUs were a common component used for basic AI tasks, but as AI advances they are used less frequently. The power of an AI depends on the number and size of transistors it employs. The more, and smaller, the transistors, the more advanced the AI chip is.

AI chips need to do lots of calculations in parallel rather than sequentially, and the data they process is immense.

Think about it

It’s been proposed by some that designing AI chips and networks to perform like the human brain would be effective. If the chips acted similarly to synapses, only sending information when needed, instead of constantly working.

For this use, non-volatile memory on a chip would be a good option for AI. This type of memory can save data without power, so wouldn’t need it constantly supplied. If this was combined with processing logic it could make system on a chip processors achievable.

What is the cost?

Despite the designs being created for AI chips, production is a different challenge. The node size and costs required to produce these chips is often too high to be profitable. As structures get smaller, for example moving from the 65nm node to the latest 5nm, the costs skyrocket. Where 65nm R&D cost $28 million, 5nm costs $540 million. Similarly with fab construction for the same two nodes, price increased from $400 million to $5.4 billion.

Major companies have been making investments into the R&D of AI chip infrastructure. However, at every stage of the development and manufacturing process, huge amounts of capital are required.

As AI infrastructure is so unique depending on its intended use, often the manufacturers also need to be highly specialized. It means that the entire supply chain for a manufacturer not yet specialized will cost potentially millions to remodel.

Beauty is in the AI of the beholder

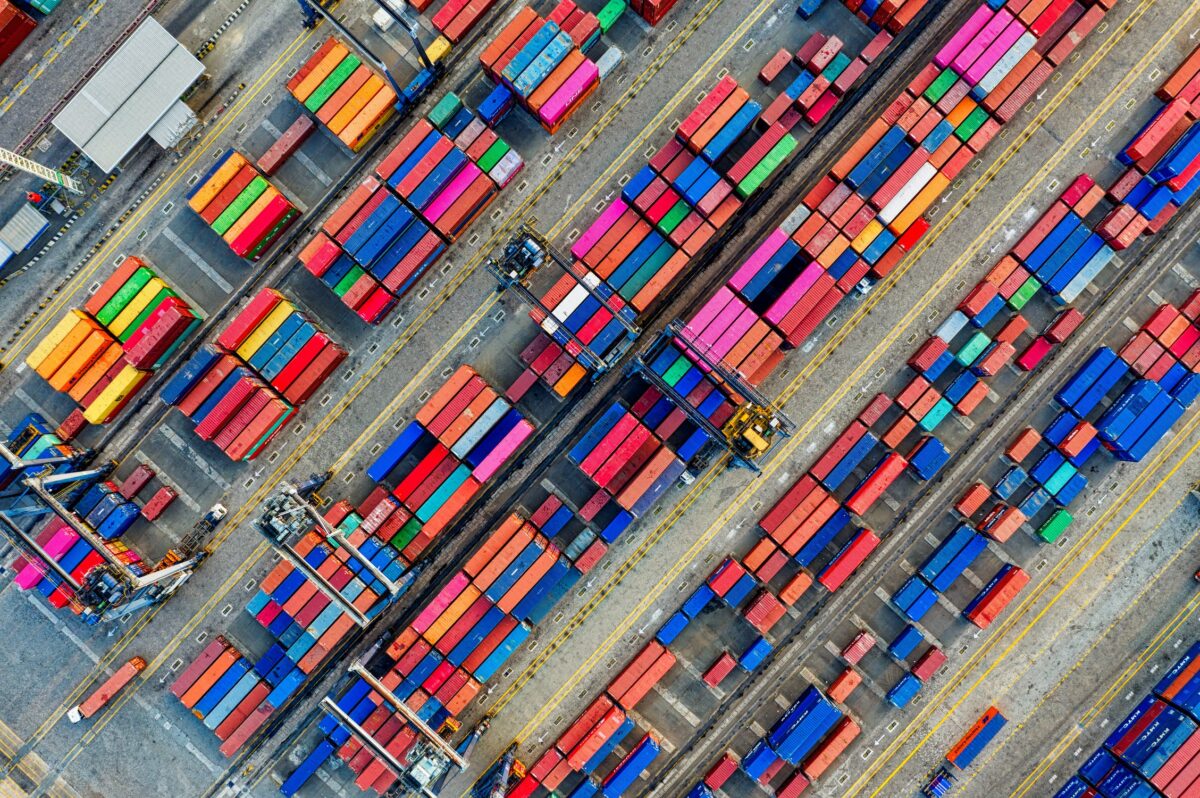

The use of AI in the electronics industry could revolutionize how we work, and maximize a company’s profits. It could aid companies in supply forecasts and optimizing inventory, scheduling deliveries and so much more.

In every step of the electronics supply chain there are time-consuming tasks that AI and machine learning could undertake. In the sales stage, AI could assist with customer segmentation and dynamic pricing, something invaluable in the current market. It could additionally prevent errors in the manufacturing process and advance the intelligence of ICs and semiconductors manufactured.

Artificial intelligence

We’re not quite at the stage where AI has permeated throughout the industry but it’s highly likely that it will in the coming years. That said, this blog post is all speculation and is in no way to inform decisions.

Lantek can provide all types of electronic components, no matter what you’re building. See how we can help you by getting in touch today. Contact us at sales@lantekcorp.com, or use the rapid enquiry form on our website to get results fast.