Electronic Components of a hearing aid

Hearing aids are an essential device that can help those with hearing loss to experience sound. The gadget comes in an analogue or digital format, with both using electronic components to amplify sound for the user.

Main components

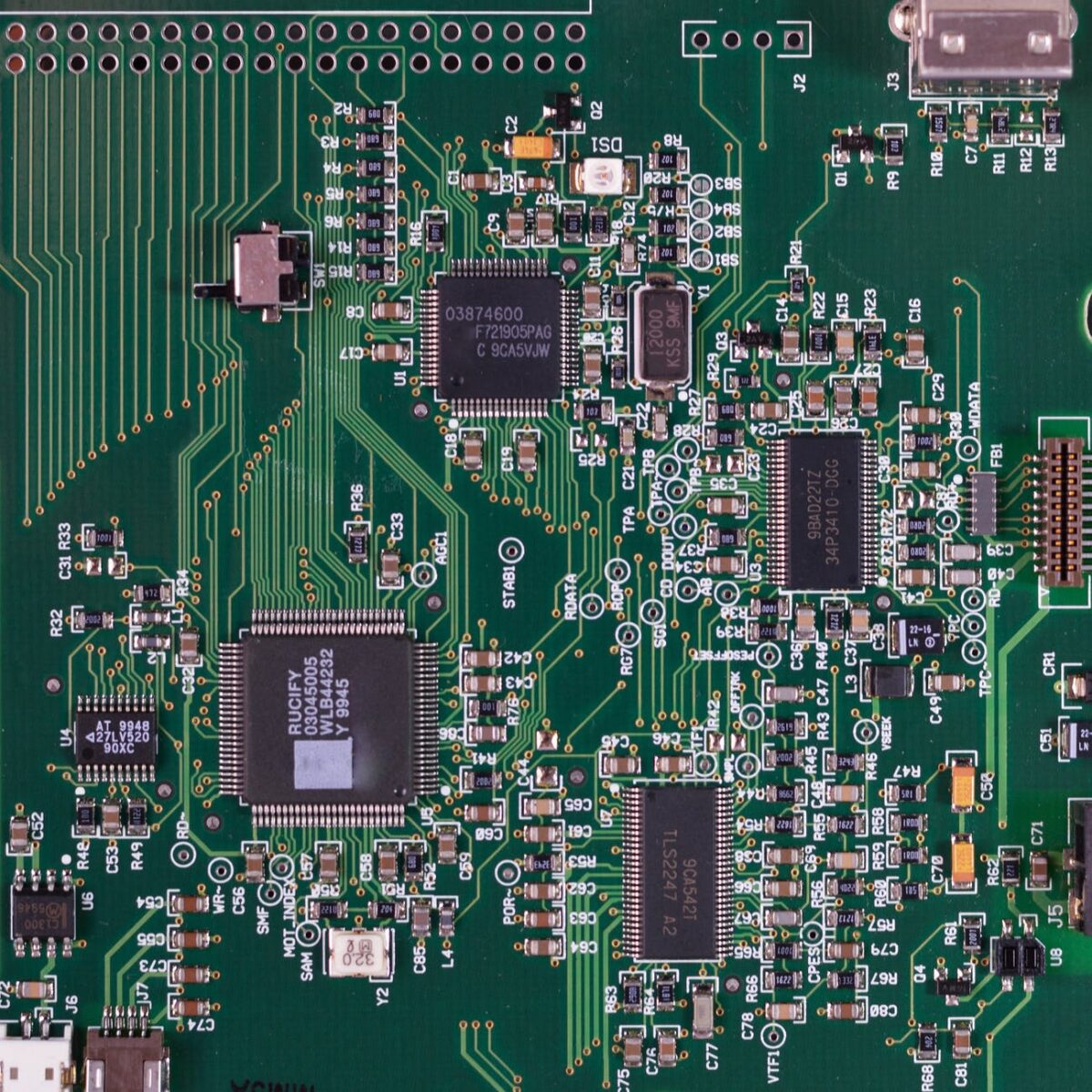

Both types of hearing aid, analogue and digital, contain semiconductors for the conversion of sound waves to a different medium, and then back to amplified sound waves.

The main components of a hearing aid are the battery, microphone, amplifier, receiver, and digital signal processor or mini-chip.

The battery, unsurprisingly, is the power source of the device. Depending on the type of hearing aid it can be a disposable one or a rechargeable one.

The microphone can be directional, which means it can only pick up sound from a certain direction, which is in front of the hearing aid user. The alternative, omnidirectional microphones, can detect sound coming from all angles.

The amplifier receives signals from the microphone and amplifies it to different levels depending on the user’s hearing.

The receiver gets signals from the amplifier and converts them back into sound signals.

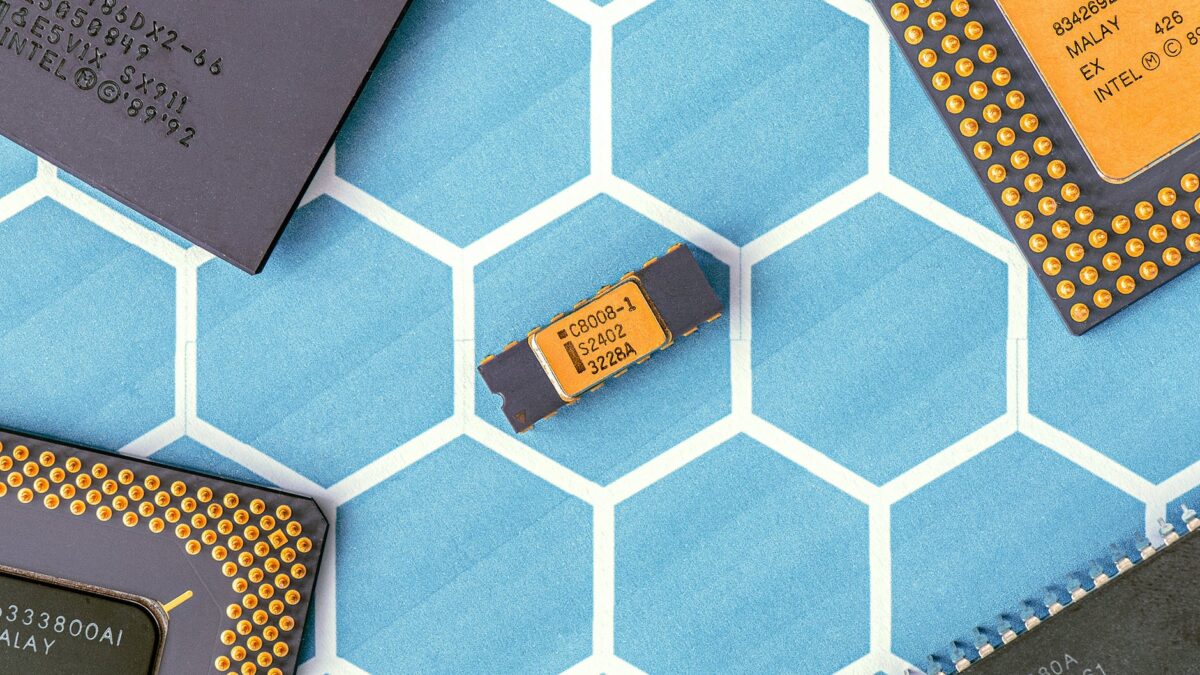

The digital signal processor, also called a mini-chip, is what’s responsible for all of the processes within the hearing aid. The heart of your hearing, if you will.

Chip shortages

As with all industries, hearing aids were affected by the chip shortages caused by the pandemic and increased demand for chips.

US manufacturers were also negatively impacted by Storm Ida in 2021, and other manufacturers globally reported that orders would take longer to fulfil than in previous years.

However, despite the obstacles the hearing aid industry faced thanks to covid, it has done a remarkable job of recovering compared to some industries, which are still struggling to meet demand even now.

Digital hearing aid advantages

As technology has improved over the years, traditional analogue hearing aids have slowly been replaced by digital versions. Analogue devices would convert the sound waves into electrical signals, that would then be amplified and transmitted to the user. This type of hearing aid, while great for its time, was not the most authentic hearing experience for its users.

The newer digital hearing aid instead converts the signals into numerical codes before amplifying them to different levels and to different pitches depending on the information attached to the numerical signals.

Digital aids can be adjusted more closely to a user’s needs, too, because there is more flexibility within the components within. They often have Bluetooth capabilities too, being able to connect to phones and TVs. There will, however, be an additional cost that comes with the increased complexity and range of abilities.